Low Income Housing Tax Credit (LIHTC)

Low Income Housing Tax Credit (LIHTC)

The Low-Income Housing Tax Credit (LIHTC) Program, created by the Tax Reform Act of 1986, is intended to encourage the construction or rehabilitation of low-income rental units. The regulations which govern this Program are contained in Section 42 of the Internal Revenue Code. This program provides Federal tax credits to qualified project owners who agree to maintain all or a portion of a project's units of low-income individuals or families. Under the Commonwealth of the Northern Mariana Islands (CNMI), the Northern Marianas Housing Corporation (NMHC) has been designated as the agency responsible for the administration of the Federal LIHTC program for the CNMI.

2025 LIHTC Application Submission Deadline Information:

Please click on the link below to access the application:

2023 LIHTC Application Submission Deadline Information:

To access the application please click on the link below:

Qualified Allocation Plan (QAP): To access the 2023-2024 QAP, please click on the link below.

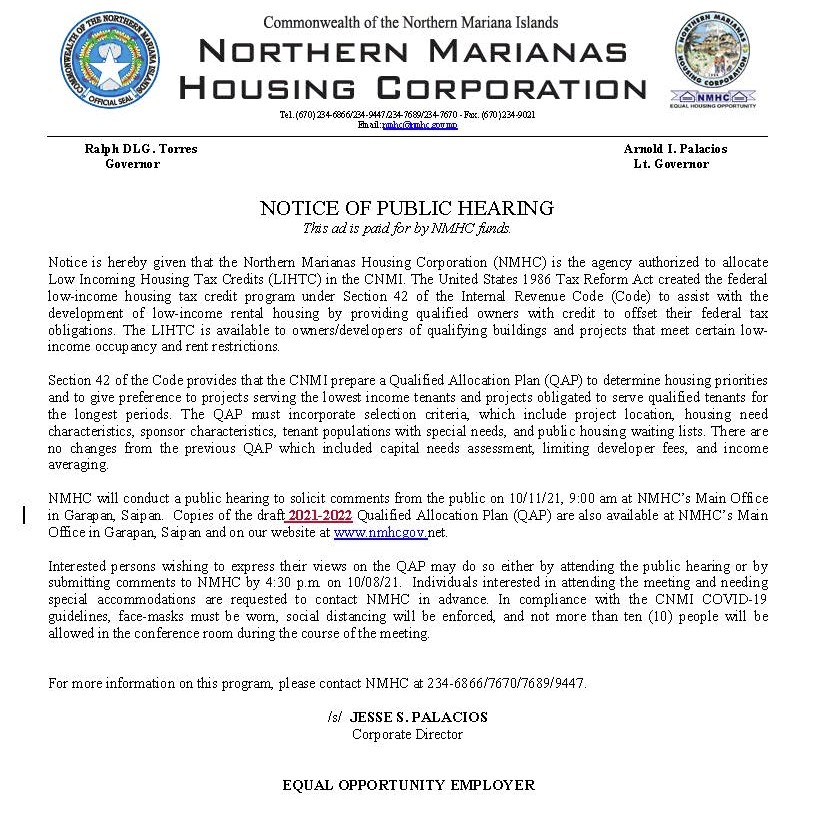

2023-2024 Qualified Allocation Plan (QAP) Public Hearing Notice:

Please click on the link below to access the plan.

2023 LIHTC Application:

Qualified Action Plan:

For more information on the 2021-2022 Qualified Action Plan, please click on the link below.

Public Notices:

To access the LIHTC Qualified Action Plan (QAP) please click on the link below:

2021-2022 CNMI LIHTC QAP-DRAFT

2022 LIHTC Application: